Orange County 3Q 2023 Industrial Market Report

OVERVIEW

and new construction showed little change. Active lease requirements have declined, and high interest rates are keeping the number of owner / user transactions below historical levels. Average asking lease rates moved up again in Q3, but with buildings taking longer to lease,

price reductions are becoming more common. Quality product, appropriately priced, is moving fastest, but marketing time is now measured in months rather than days or weeks as it was just a year ago. Availability of buildings for sale is still markedly thin, and that has kept average asking sales prices from retreating significantly, despite mortgage interest rates approaching the 7% threshold.

VACANCY & AVAILABILITY

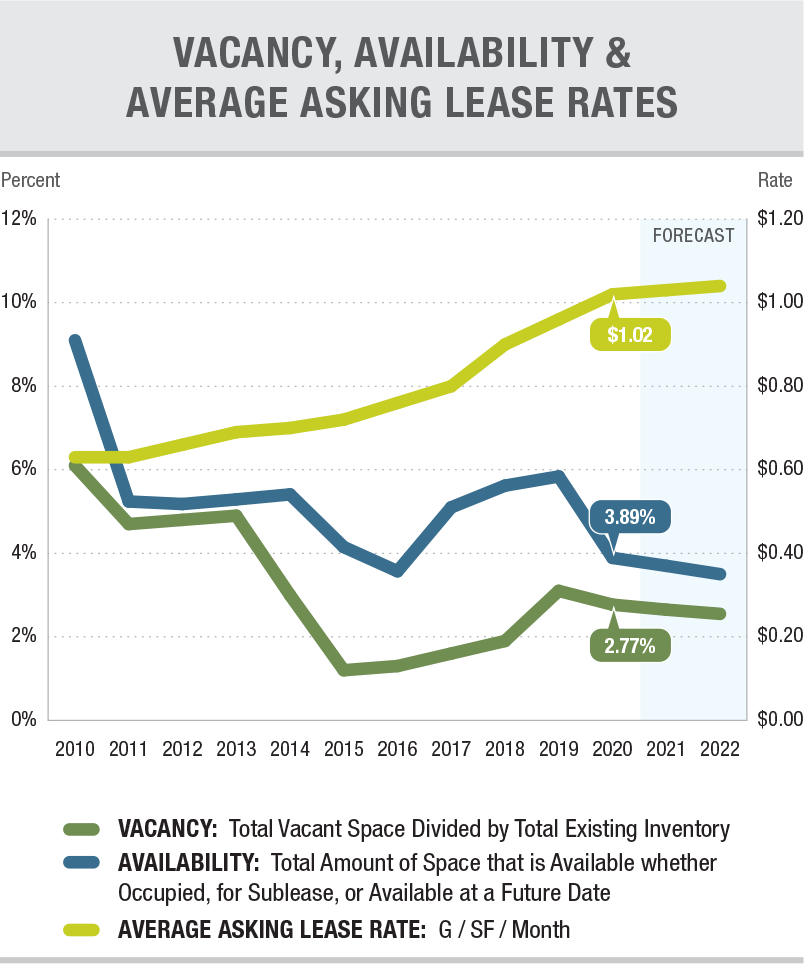

Orange County’s vacancy rate increased to 2.58% in Q3, up by 56 basis points from Q2. The availability rate, which includes currently occupied space offered for sale or lease, rose to 4.65%, marking a 71-basis-point increase following an 83-basis-point jump in Q2. The increase in space offered for sublease is putting extra pressure on availability. Tenants have more choices and are becoming more demanding on concessions like free rent and tenant improvements, even for buildings of higher quality. Less desirable space, lacking the modern features required by warehouse tenants, leases slowly. Both institutional and private landlords are emphasizing creditworthiness and seeking longer terms, in reaction to the market softening.

LEASE RATES & SALES PRICES

LEASE RATES & SALES PRICES

The average asking lease rate countywide moved up again in Q3, despite the significant rise in vacancy. Overall, the county saw the rate move up another $0.05 PSF in Q3 to $1.73 after a similar increase in Q2. Year over year, asking rents have grown by 16.9%, despite the rise in vacancy and the slowdown in active requirements. However, the trajectory of rent growth is definitely flattening. The average asking sales price fell by $27 PSF in Q3 to just over $397 PSF, following an increase of $24 PSF in Q2. Rising mortgage rates in Q3 led potential buyers to await price reductions, but demand still absorbs the limited inventory, maintaining pricing near peak levels.

TRANSACTION ACTIVITY

Lease and sale activity dipped in Q3 both on a quarterly and year-over-year basis, and the supply of high-quality, functional space remains low. Active requirements in the market slowed again during the period. Those tenants and buyers still in circulation are becoming more selective and are less inclined to make decisions as quickly as they were in recent years when vacancy hovered in the 1% range. The number of lease transactions decreased to 176 in the period from 228 in Q2, but the number of sales rose to 44 from 32 in Q2. Total lease and sale activity by square footage fell to 1.8 MSF from just under 4 MSF in Q2. However, year-over-year sale and lease activity is down by over 65% and time on the market has moved higher. The biggest sale of the quarter was a 99,552 SF building in Brea, with total consideration of $32.8 million. The largest lease was for 146,482 SF to Bio-Rad on Jeronimo Road in the Irvine Spectrum.